The traditional approach to Collection as a Service (CaaS) typically involves manual and resource-intensive processes. This includes sending physical letters, making phone calls, and dispatching field agents to interact with customers who are behind on payments or debts. These methods are not only time-consuming but can also be costly due to the need for physical infrastructure, such as call centers and office space. Additionally, data analysis in traditional collections is often rudimentary, relying on historical records rather than predictive analytics. This limits the ability to proactively manage delinquency and understand customer behaviour patterns.

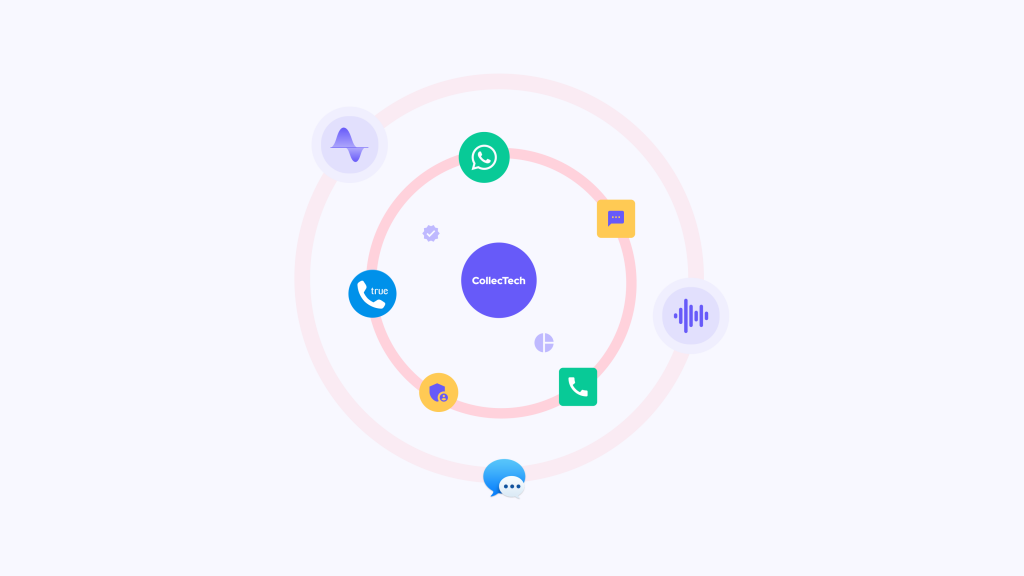

The new age digital approach revolutionises Collection as a Service by harnessing technology and data-driven insights. Automation plays a pivotal role, with chatbots, emails, and SMS messages replacing or augmenting traditional communication methods. This automation not only accelerates the outreach to customers but also provides a more convenient and flexible experience for them. Furthermore, advanced data analytics and machine learning are employed to analyse historical and real-time data, enabling the prediction of customer behaviour and the identification of early warning signs for potential delinquency. This proactive approach allows companies to intervene and tailor their collection strategies more effectively.

From the lender’s perspective, real-time visibility and transparency in debt collection provide a valuable edge. It empowers lenders with immediate access to customer data, enabling data-driven decisions, efficient resource allocation, and proactive risk mitigation. This enhanced visibility fosters better customer engagement through real-time updates and personalized interactions, strengthening relationships and trust. Additionally, it aids in compliance and reporting, ensuring that lenders meet regulatory requirements while optimizing their operations for the digital age. In essence, these benefits position lenders for more successful and ethical Collection outcomes.

The new age digital approach to CaaS (Collection as a Service) represents a profound shift from the traditional methods. It provides real-time visibility, leverages data analytics for predictive insights, and enhances the borrowers’ experience. By embracing technology, it provides an effective, proactive, and customer-centric solution for managing Collections in today’s fast-paced, digital landscape.