At DPDzero, our commitment to reshaping India’s financial landscape and improving collections for lending companies is unwavering. A pivotal part of our strategy involves our Data Ingestion Engine, which seamlessly gathers and processes data from various sources. However, our primary goal is to enhance security while simplifying the data exchange process for our valued customers—lending companies.

Every lending organisation we work with us different – so is their data. DPDzero is a collection platform which accepts data in a certain format. We built the ingestion engine to deal with this exact problem – how do we ensure that our customers can can work with us with least amount of friction.

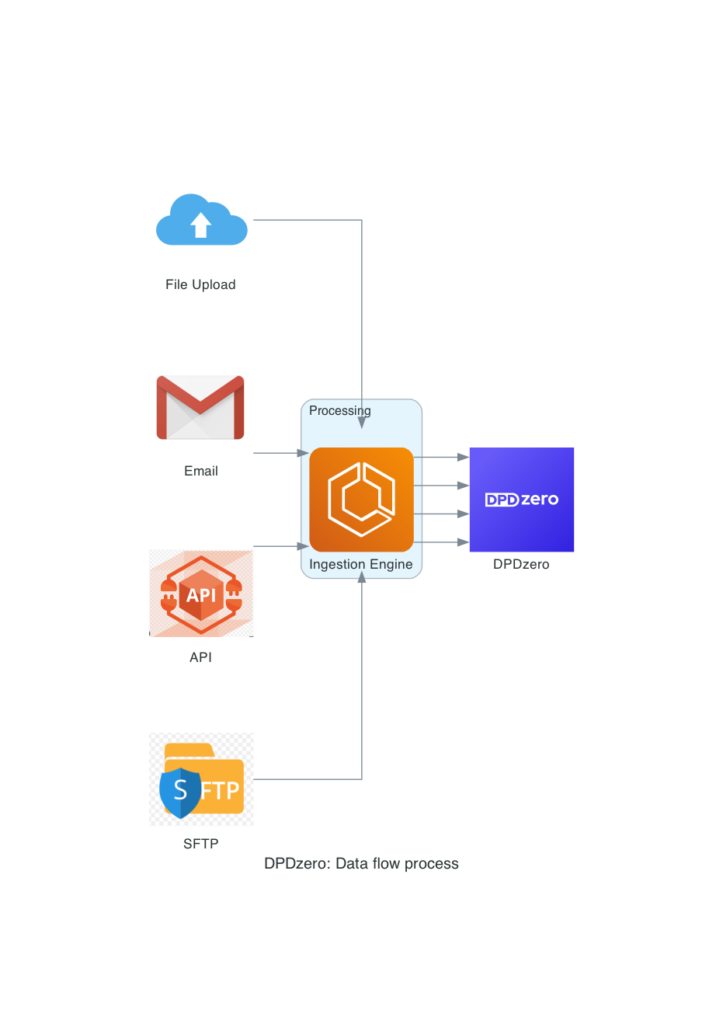

Below diagram represents how data flows from our customers’ systems into DPDzero platform in various ways. Ingestion engine extracts the data from customer’s systems or files and transforms it into DPDzero data format and loads the data into DPDzero platform.

1. Enhanced Security through Automation

Security is paramount in the financial sector. We understand the critical importance of safeguarding sensitive data. That’s why we’ve taken the initiative to automate the entire data exchange process. By eliminating manual intervention, we significantly reduce the risk of delays and errors that can arise when people are involved in data exchange.

Our commitment to automation means:

- Reduced Human Error: Automation minimizes the chances of human errors during data exchange, ensuring data integrity and accuracy.

- Fast Data Synchronization: Automated processes ensure rapid data synchronization between the lender’s core systems and DPDzero systems. This enables lending companies push up-to-the-minute information to DPDzero for informed decision-making.

- Enhanced Data Privacy: Automated data exchange reduces the exposure of sensitive data to potential security threats associated with manual handling.

2. Seamless Data Exchange

We’ve also streamlined the way data is exchanged with us. Lending companies no longer need to download Excel files or CSV files. Instead, they can directly upload data to our system or simply send an email. Our system takes care of the rest, automatically processing the data without any additional steps or delays.

This approach offers several advantages:

- Efficiency: Lending companies can focus on their core operations while our automated system handles data exchange seamlessly.

- Convenience: Data can be uploaded or emailed, making it incredibly convenient for our customers to collaborate with us.

- Data Integrity: The automated process ensures that data remains intact and unaltered during exchange, preserving its integrity.

The Impact

Here’s the impact of our security-focused, automated approach:

- Enhanced Data Security: Automation reduces the risk of data breaches and ensures that sensitive information is protected.

- Efficiency and Timeliness: Fast data synchronization enables lending companies to operate more efficiently and make timely decisions, crucial in the fast-paced financial industry.

- Streamlined Collaboration: Simplified data exchange means less friction in collaboration, making it easier for lending companies to work with us.

In conclusion, DPDzero is dedicated to automating data exchange for lending companies to enhance security and streamline collaboration. By eliminating manual steps, reducing human error, and providing convenient ways to share data, we’re making significant strides toward a more secure and efficient financial system. In a country with vast untapped potential, DPDzero is leading the way in leveraging data for positive change while prioritizing data security and ease of use for our valued partners.